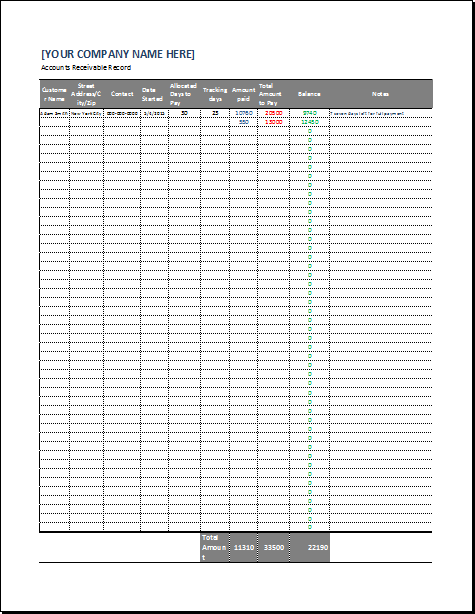

It is a professionally used tool that businesses use these days for record-keeping purposes. When customers buy products from a business on credit, they are given an account that they own in the business. A business keeps track of all the credit it is yet to receive from its customers in the receivables ledger.

A sales ledger is one of the most important tools of a business, as it makes the accounting system of the company smooth and also helps the business monitor and manage all the money that is to be received from the customer. This way, a business remembers who to receive money from and manages to balance the inflow and outflow of cash.

What should I include in the account receivable ledger?

You will have to create a document for record-keeping that can adjust all the details in it that are necessary for helping an organization get information about the amount that has yet to be received. Usually, those who purchase products on credit or installments have a unique account with the company, and a record of every individual customer is kept in the company’s database.

If you are thinking of creating your own ledger account, make sure that you add the following details to a document to make it a worthy tool for the record-keeping of receivables without any confusion. Here are some key details to be added:

Information about the customer

The most important information for a company is to mention who to receive money from. Therefore, the customer is the main entity in the ledger. The details of the customer, such as name, contact details, residential address, etc., are mentioned. The unique account number of the customer is also mentioned in the account. A business keeps these details safe in its database for its own security.

Details of the purchase

The information about the shopping is recorded in the receivables ledger when a customer purchases something on credit. At the time of the purchase, the business issues an invoice to the customer. The details, such as the unique invoice number, date of issuance of the invoice, and description of the product sold to the customer on credit, are mentioned.

Details of the receivable amount

In this part of the document, a business keeps a record of the total amount that is required to be received by the customer. If the customer is paying the amount in installments, the ledger will be updated with the new receivable money owned by the customer.

History of the payment

The business also keeps a record of all the payments that the customer has made in the past. The dates of each payment are also given. This information is important when a business wants to evaluate whether a customer should be allowed to buy another product on credit or not.

The current balance of the customer:

Since the buyer has an account with a company, you also owe some money on that account. The business keeps a record of that balance to determine if the customer will be in a position to pay the amount. Keeping these details at hand is essential because the account holder can request the account details. When a business immediately shares those details with the buyer, it reflects professionalism. Through the current balance, the outstanding amount can also be evaluated after deducting the receivable amount.

Terms and conditions of paying on credit

Those who decide to buy things on credit from a business should know under what conditions this is allowed to happen. Since the customer already has an account with the business, it shows that he has shown his willingness to accept all the terms and conditions. Therefore, there are few or no chances for any dispute to arise at any given time.

Account receivable template

A ready-made document for record-keeping saves you time and provides you with a utility that can be very useful for you. This template is flexible because it allows you to modify it according to your needs. If you want to record some more details in the customer ledger, you can easily extend it at your convenience. In addition, a template gives you a professional-looking document.